The ‘Cash-for-Credit’ Revolution: How An Indian Application, Orus Technologies, is Helping Indians Monetize Their Wallets

(India) – In the crowded world of fintech, most apps want you to spend money. But a new player emerging from India’s Tier-2 industrial belt is promising the opposite: paying you to use your credit card. Orus Technologies, a rapidly growing platform, has introduced a novel concept that bridges the gap between savvy cardholders and discount-seeking shoppers.

The “Credit Arbitrage” Model Explained

At its heart, Orus Technologies solves a simple inefficiency. E-commerce giants frequently roll out bank-specific discounts (e.g., “10% Instant Discount with ICICI”). If you have the card but no intent to buy, that value is typically lost.

Orus changes this dynamic. The platform connects cardholders with shoppers who need those specific electronics or goods.

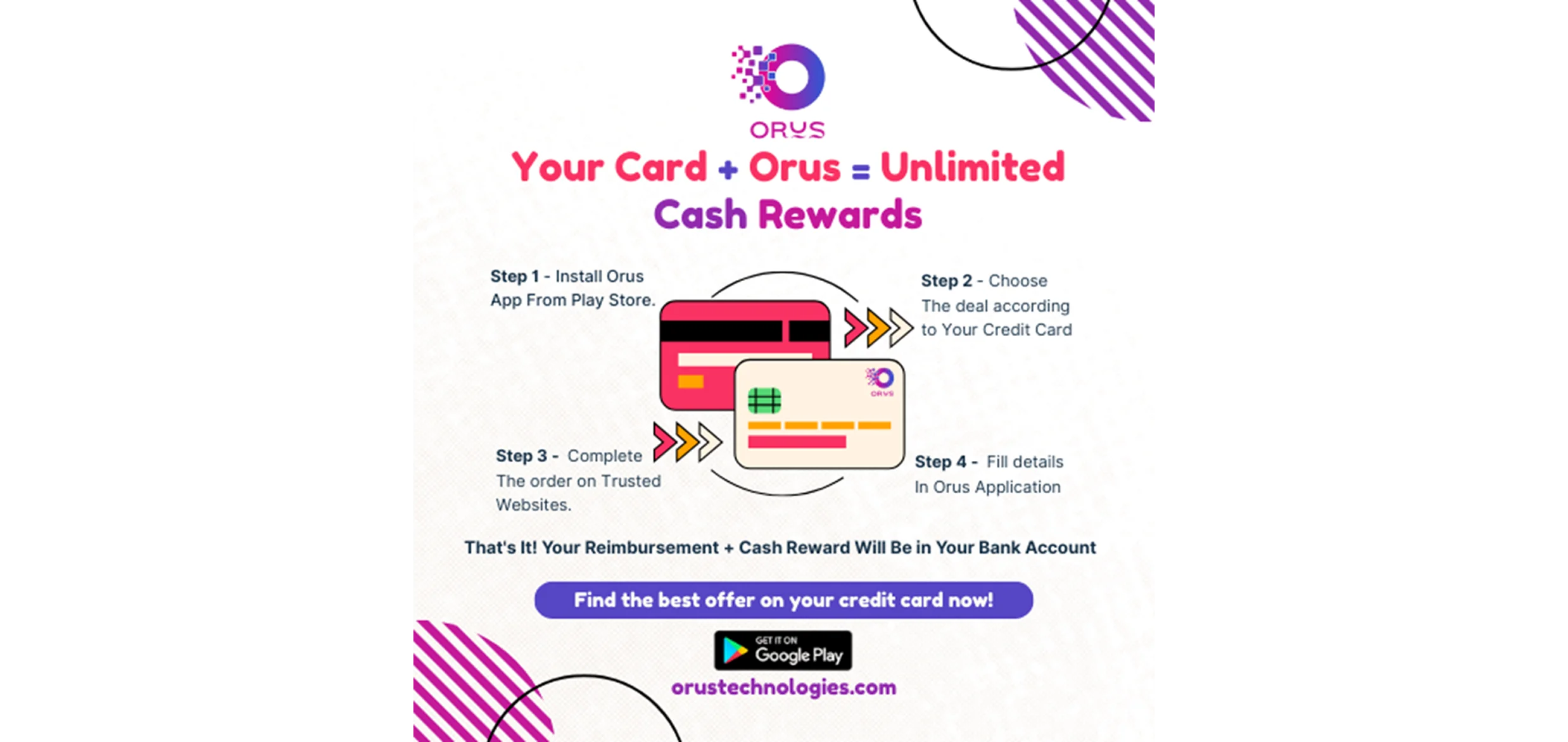

The Transaction: The Cardholder buys the item using their card, utilizing the bank discount.

The Fulfillment: The Shopper receives the product they wanted.

The Payday: Orus reimburses the cardholder the full amount plus a Cash Reward, directly into their bank account.

Why It’s Blowing Up: The Numbers Don’t Lie

Data indicates that Orus is hitting a nerve with India’s aspirational middle class. The platform has now surged past 25,000 active users, a testament to the growing appetite for smart financial tools.

While recent growth metrics reveal a 38% increase in the active client base within a single quarter, the real story is in the earnings. This isn’t just about small change; for “power users,” it is a significant side hustle.

Impact Highlight: Several top-tier users on the platform have reported earning more than ₹1 Lakh in a single year strictly through cash rewards and card benefits facilitated by the app.

By routing purchases through Orus, users are effectively:

Converting Credit to Cash: Liquidating their credit limit without paying the exorbitant cash-withdrawal fees charged by banks.

Hitting Annual Milestones: Reaching spending targets (e.g., for fee waivers, airline status, or luxury vouchers) without personal expenditure.

Earning Passive Income: Generating hundreds to thousands of rupees monthly just by lending their “transaction power.”

Safety First in a Trust-Based Economy

“We built Orus with safety as the cornerstone,” says the leadership team. To combat online fraud and ensure transparency, the platform utilizes a robust verification process.

Payouts are released to the cardholder only after the delivery is successfully verified via OTP and tracking systems, ensuring a risk-free loop for all parties involved.

The Verdict

As credit card penetration in India hits record highs, Orus Technologies is positioning itself not just as a shopping app, but as a secondary market for financial perks. For the savvy Indian consumer, it’s no longer just about having a credit card—it’s about putting it to work.

Media & Download Information

Website: www.orustechnologies.com

Download the App: Orus is now available on both the Google Play Store and the Apple App Store.

Play Store Download Link: Click here to Download Orus

App Store Download Link: Click here to Download Orus