AI Boom: The Next Wealth & Consumption Revolution

Introduction: The New Economic Inflection Point

The global economy is experiencing its largest productivity boost since the internet revolution. Artificial Intelligence is generating a $1.81 trillion addressable market by 2030 from $391 billion today, fundamentally altering how organizations create value and how individuals capture that value through compensation. India is uniquely positioned at the center of this transformation.

While 72% of global organizations have adopted AI in at least one business function, India leads across multiple dimensions. 30% of Indian companies have maximized AI’s value potential versus 26% globally, among tech-based roles, an exceptional 92% of professionals in India regularly use AI tools — the highest globally. 73% of Indian businesses plan expanded AI implementation by 2025 compared to 52% globally.

The result is a concentrated wealth effect targeting India’s working age demographic: professionals earning AI-era premiums earlier in their careers, with higher disposable incomes and consumption preferences shaped entirely in the digital age. This cohort demonstrates high willingness to pay for convenience, preference for premium experiences, and comfort with digital-first brands across categories.

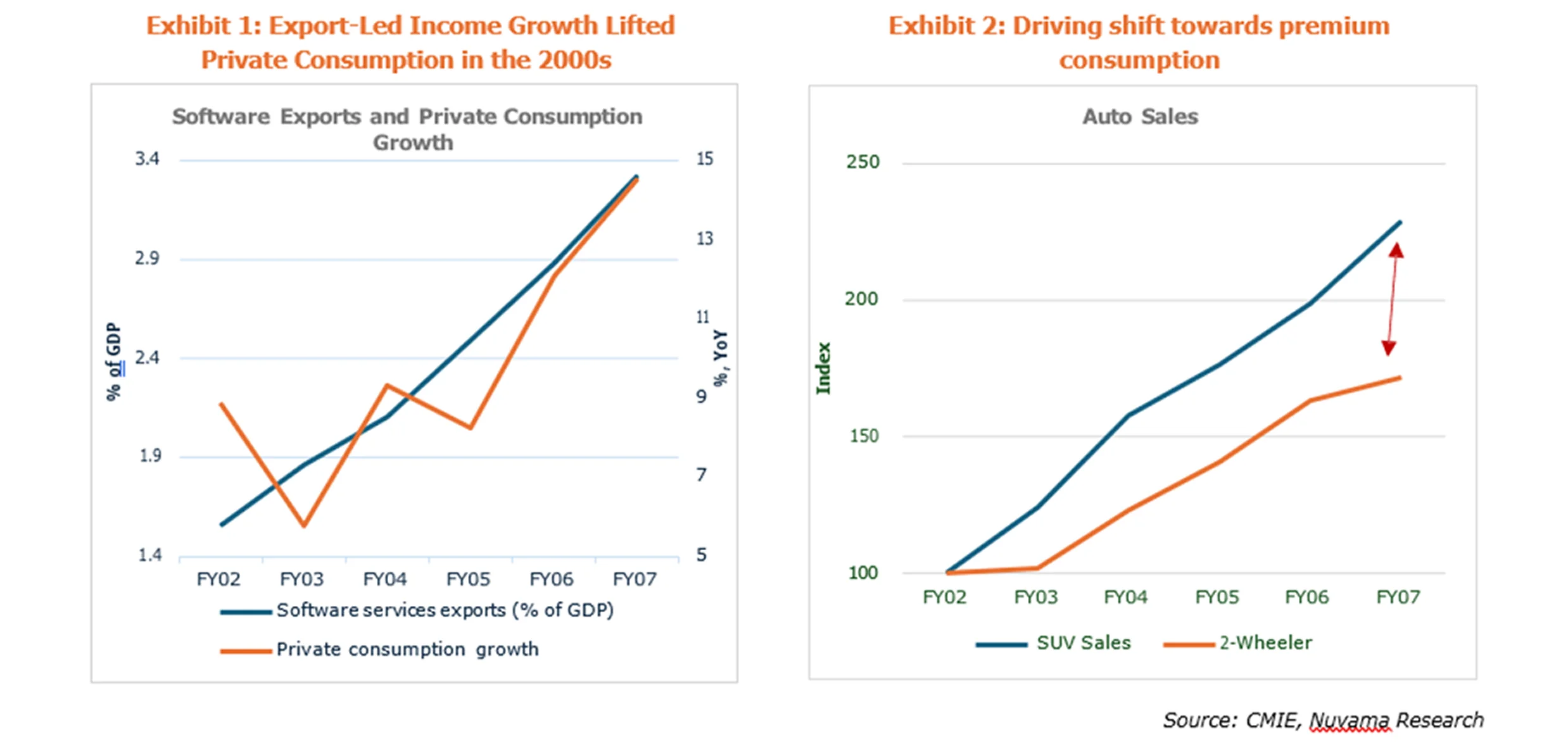

The First Wave: How Software Exports Ignited India’s Consumption Story

In the 2000s, India’s IT boom reshaped the economy. As software exports rose from about 1% to over 4% of GDP, they powered income growth, urban jobs, and a surge in household spending. The tech wave didn’t just bring dollars — it created a new middle class and a culture of aspiration.

Between FY02 and FY07, passenger vehicle sales in India expanded much faster than two-wheelers, reflecting a structural shift in mobility preferences. Within passenger vehicles, SUVs recorded the sharpest growth, emerging as the key driver of premiumization. This period marked a clear move from basic transportation to aspiration-driven ownership, as rising incomes, affordable financing, and a growing middle class encouraged consumers to upgrade from two-wheelers and small cars to larger, more comfortable SUVs that symbolized lifestyle and status.

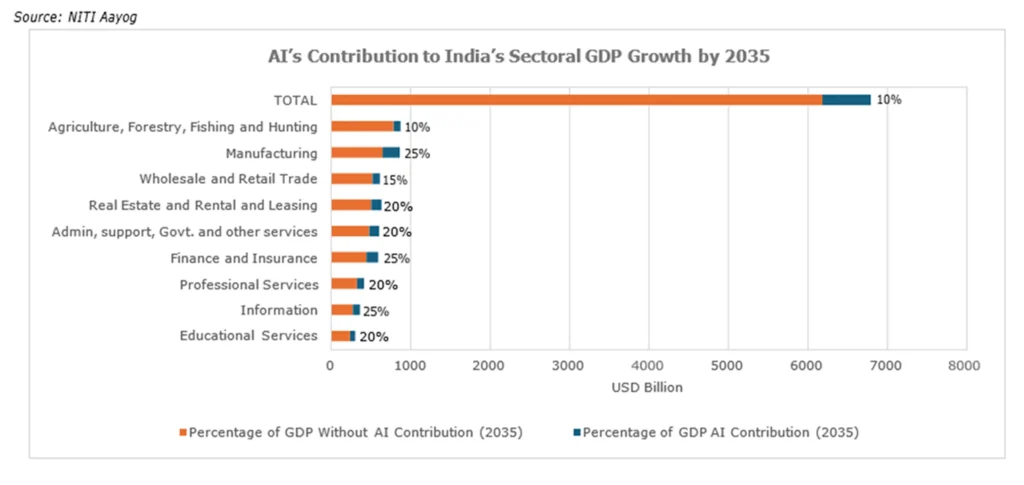

AI for Viksit Bharat: The Next Productivity Revolution

By 2035, artificial intelligence could become one of India’s strongest growth engines, adding $450–500 billion to GDP nearly 10 percent of the economy’s size. According to the AI for Viksit Bharat report, the biggest uplift will come from manufacturing, where smart factories, predictive maintenance, and robotics can transform productivity. Financial services will see AI-driven credit scoring, fraud detection, and personalized products deepen inclusion. IT and professional services will evolve into innovation hubs through automation and new digital offerings, while healthcare, education, and agriculture will benefit from better access, efficiency, and resource use. Together, these shifts signal that AI is not just another wave of automation it’s the next great productivity revolution, reshaping India’s growth story much as the IT boom did two decades ago.

This staggering growth projection is backed by foundational investments that guarantee high-income job creation:

- Global Infrastructure and Investment: The $15 billion Google AI hub and India’s ₹107 billion public investment in AI data centers are anchoring global-scale operations and high-tech jobs within India, laying the groundwork for durable domestic wealth creation.

What Software Exports Did in the 2000s, AI Will Multiply in the 2030s

India’s AI revolution is reshaping its economic hierarchy much like the IT export boom of the early 2000s but on a far larger scale. As per EY–Microsoft (2024) and Accenture (2023), AI could contribute up to 10–15 % of GDP by 2035, unlocking nearly US $900 billion in value. The traditional IT services sector in India is a significant contributor to the country’s economy, accounting for about 7.5% of India’s GDP as of the financial year 2023. This sector is poised for strong growth, with its revenue projected to double to approximately Rs. 43.1 lakh crore (about US$ 500 billion) by 2030. The IT ecosystem is expanding rapidly, driven by demands from various verticals like BFSI, telecom, and retail, and the emergence of new technologies such as AI and engineering R&D.

How AI Will Power the Next Leap in India’s Economic Story

1. Productivity Revolution Through AI-Powered Work

Indian workers are already saving 1.3 hours daily with AI and seeing 33% productivity boosts. By 2030, 38 million jobs will transform—not disappear—as AI handles routine work while humans focus on strategic tasks.

This shift is enabling lean startups. What once required large teams can now be done by small groups using tools like GPT-4 and GitHub Copilot. India’s 520+ tech incubators and AI startups are growing 25–35% annually, allowing even non-technical founders to build sophisticated products.

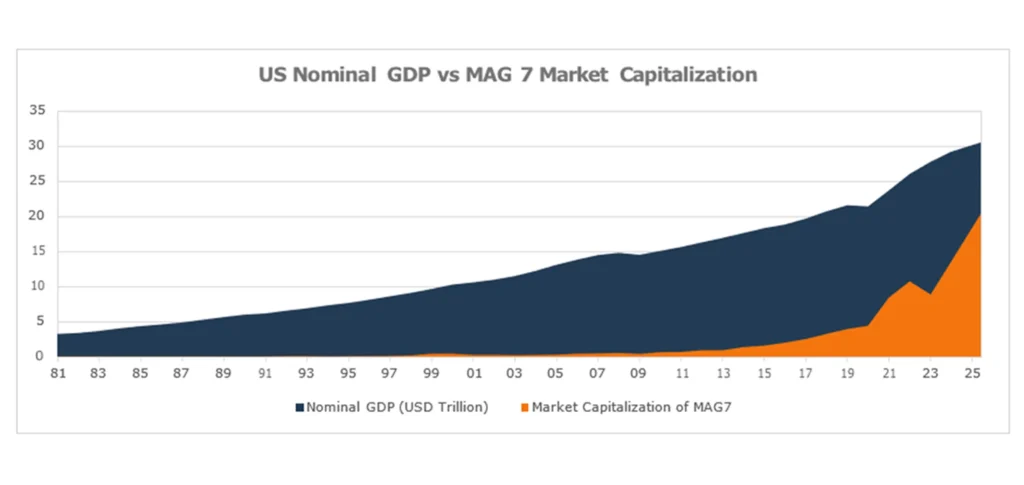

2. Stock Market Surge from AI Companies

In the US, AI companies have driven unprecedented market cap growth. Nvidia alone hit $5 trillion in market cap and now represents 8% of the entire S&P 500. The “Magnificent Seven” tech giants have seen massive valuations driven by AI infrastructure and applications. Across the US, China, Japan, and South Korea, AI companies have contributed 14–58% of total market cap growth over the past three year.

India is yet to follow suit. While the country now has 73 unicorns—including AI-focused companies like Ai.tech (conversational AI), Yellow.ai (AI chatbots for Fortune 500), and Uniphore ($2.5B valuation in speech analytics)—these remain private. India’s large IT firms like TCS, Infosys, and Wipro are embedding AI into operations but haven’t yet seen the valuation surge of their US counterparts.

3. More AI Companies Going Public

India’s IPO market is projected to raise $18 billion in 2025—third globally. The pipeline is increasingly tech and AI-heavy, with AI companies spanning conversational AI, speech analytics, healthcare diagnostics, fintech solutions, and agriculture.

The government’s ₹10,300 crore IndiaAI Mission is accelerating this by funding infrastructure. As more AI companies achieve scale and go public, their contribution to market capitalization will match developed markets, attracting global investors and funding the next generation of AI innovation. As India’s AI unicorns go public and established tech firms demonstrate AI-driven value, India’s markets will experience similar AI-fuelled market cap growth that transformed US exchanges.

4. More Advanced Capital Markets

As AI boosts disposable incomes, more money will flow into India’s capital markets. Equity penetration in India remains very low compared to developed markets—most household savings still sit in fixed deposits and gold.

As wealth increases from AI-driven productivity, more individuals will shift savings into equities and mutual funds. This growing investor base will deepen market liquidity, drive demand for sophisticated investment products, and attract international capital— creating a self-reinforcing cycle of market development and wealth creation.

5. Expanding AI-Powered Lifestyle and Luxury Spending

Artificial intelligence is transforming urban consumption in India, enabling unprecedented convenience and personalization across key lifestyle sectors as rising disposable incomes fuel luxury spending.

- Food & Grocery: Premium food delivery is booming through AI-powered personalization, dynamic pricing, and optimized logistics. Platforms like Swiggy Gourmet and Zomato Gold offer exclusive fine-dining partnerships, with the food delivery AI market projected to grow at 52% CAGR through 2028.

- Home & Lifestyle: Urban Company taps growing demand for outsourced household services. AI-enabled smart home devices from automated lighting to security systems are rapidly gaining adoption among metro households through cloud-based

- Travel & Aviation: Digital travel searches are growing 8-12% Airlines like IndiGo and Vistara use AI for dynamic pricing and personalized loyalty programs.

Premium outbound travel surged 32% with average spends exceeding $8,500 per trip in 2025.

- Hotels & Leisure: Premium hotels maintain 70-74% occupancy with room rates of Rs. 7,800-8,500. Taj and Oberoi deploy AI chatbots, predictive analytics, and contactless services to enhance guest experiences.

- Real Estate: Luxury real estate sales jumped 85% year-on-year in H1 2025, with

~7,000 units sold across major cities. Developers integrate AI virtual assistants and smart home features, while premium auto brands use AI for virtual showrooms and predictive maintenance.

India’s Consumption Pyramid Is Shifting Upward with AI-Driven Affluence

AI-generated wealth pushes India’s middle class from security to self-expression, expanding the top tiers of consumption.

India’s AI revolution is transitioning from early adoption to mainstream wealth creation. The IT boom demonstrated how high-value exports reshape consumption—AI will amplify this effect. With projections of $450-500 billion in GDP contribution by 2035, a new high-income cohort is emerging in metros and tier-1 cities. This wealth will disproportionately flow into premium real estate, luxury travel, digital convenience services, and aspirational categories that define modern affluence. The investment thesis is clear: companies positioned to capture AI-driven discretionary spending will outperform as India’s consumption pyramid shifts upward.

Sowilo Investment Managers LLP (“Sowilo”) is a boutique asset and wealth management firm catering primarily to Corporate, UHNI, HNI investors and Family offices in domestic as well as offshore markets. Sowilo is a SEBI registered Portfolio Management Service in India for HNIs, focusing on discretionary portfolio management. The team consists of professionals from various streams coming together to pursue their passion to create a platform which provides investment opportunity across asset class via equity as a superior proxy.

Regards,

Team Sowilo Investment Managers LLP

info@sowilo.co.in

Sources:

- NITI Aayog —AI for Viksit Bharat: The Next Productivity Revolution

- Microsoft — 2024 Work Trend Index: AI at Work Is Now Comes the Hard Part

- EY–Microsoft (India AI opportunity study

- Accenture — AI macro-impact research

- CMIE & Nuvama

- Stanford — AI Index Annual Report

- McKinsey; BCG; PwC

- Economic Times; NDTV — recent India market

DISCLAIMER: Any information contained in this material represents Sowilo’s views and research analysis and shall not be deemed to constitute an advice, an offer to sell purchase or as an invitation or solicitation to do for security of any entity and further Sowilo Investment Managers LLP and its employees/directors shall not be liable for any loss, damage, liability whatsoever for any direct or indirect loss arising from the use of this information. Sowilo Investment Managers LLP – SEBI Registered Portfolio Manager (INPO00008127)